By Amit Kapoor & Ankita Nigam

India US Trade Amidst Reciprocal Tariffs

Recently, with the change in administration and the return of U.S. President Donald Trump to office, a significant shift in trade policy was announced. President Trump revealed plans to impose reciprocal tariffs on countries that maintain higher tariffs on U.S. goods, including major trading partners such as India and China. On February 1, 2025, as part of this new approach, President Trump implemented a 25% tariff, a 10% duty on energy products imported from Canada and Mexico, and a 10% tariff on Chinese goods. This policy shift aims to create a more balanced trading environment, ensuring the U.S. is not disadvantaged in its trade relationships.

Trump’s latest policy decision aligns with his “America First” agenda, addressing what he perceives as unfair trade practices that disadvantage U.S. businesses. By imposing higher tariffs on imports from countries like India and China, which have long maintained steep trade barriers on American goods such as agriculture, automobiles, and technology, the strategy seeks to level the playing field. The goal is to pressure these nations to reduce their tariffs to avoid retaliatory measures from the U.S. While this could raise costs for India and China and reduce their competitiveness in the U.S. market, it reflects a protectionist approach aimed at safeguarding American industries and jobs, though it could also lead to a more fragmented global trade system.

This evolving trade policy redefines the global economic stance of the U.S. and significantly impacts the robust and dynamic trade relationship between India and the United States. The trade relationship between India and the United States is significant and dynamic, serving as a cornerstone for the economic growth of both nations. As the largest economy globally, the U.S. is a critical market for Indian exports, providing access to a vast consumer base and offering opportunities for India’s diverse industries, from technology to pharmaceuticals. At the same time, India represents one of the fastest-growing markets for American goods and services, with expanding demand for everything from energy products to advanced machinery and technology. This mutually beneficial partnership strengthens trade and fosters innovation, investment, and collaboration.

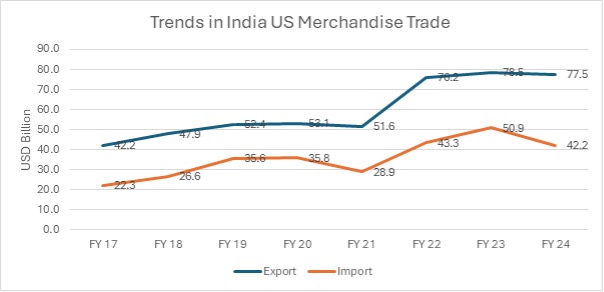

Over the years, bilateral trade between the United States and India has witnessed remarkable growth, making the United States India’s largest trading partner. In the fiscal year 2023-24, the United States accounted for 17.7% of India’s total export share, valued at USD 77.5 billion, further solidifying its position as the largest market for Indian goods. While India’s exports to the U.S. experienced a modest decline of 1.3% compared to the previous year, when exports were valued at USD 78.5 billion, the trade relationship remains crucial for India’s export growth.

Source: DGCIS, M/o Commerce & Industry

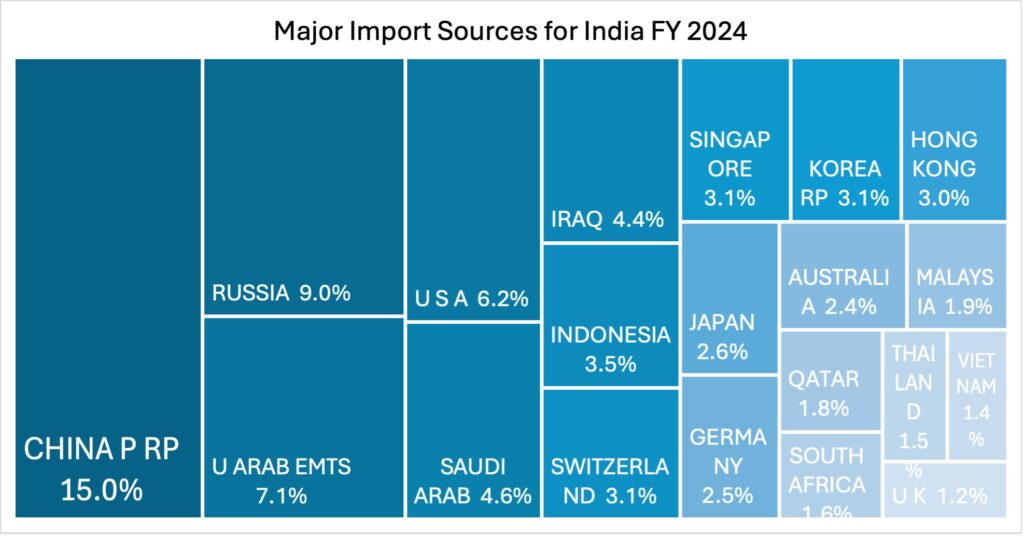

The United States remains a crucial import partner for India, contributing 6.2% to India’s total import share and ranking as the fourth-largest source of Indian imports. This highlights the significant role the U.S. plays in supplying a wide range of essential goods and services to the Indian market. The robust trade in both directions strengthen economic ties and ensures a steady flow of critical goods integral to India’s development.

Source: DGCIS, M/o Commerce & Industry

India is currently experiencing a significant trade surplus with the United States. In the fiscal year 2023-24, the total bilateral trade between the U.S. and India amounted to USD 119.7 billion. Indian exports were valued at USD 77.5 billion, while imports stood at USD 42.2 billion. This resulted in a trade surplus of USD 35.3 billion for India. Over the years, India has consistently maintained a trade surplus with the U.S., which has increased from USD 19.9 billion in FY17 to USD 35.3 billion in FY24.

India’s exports to the U.S. have experienced significant growth, rising from USD 42.2 billion in FY17 to USD 77.5 billion in FY24, at an average annual growth rate of 9.1%. Meanwhile, imports from the U.S. have also increased, growing from USD 22.3 billion in FY17 to USD 50.9 billion in FY23 before slightly declining to USD 42.2 billion in FY24. Over the FY17-24 period, imports from the U.S. grew at an average annual rate of 9.5%. This upward trend in exports and imports underscores the strengthening trade relationship between these two economies, highlighting the growing interconnectedness and economic cooperation between India and the U.S.

Source: DGCIS, M/o Commerce & Industry

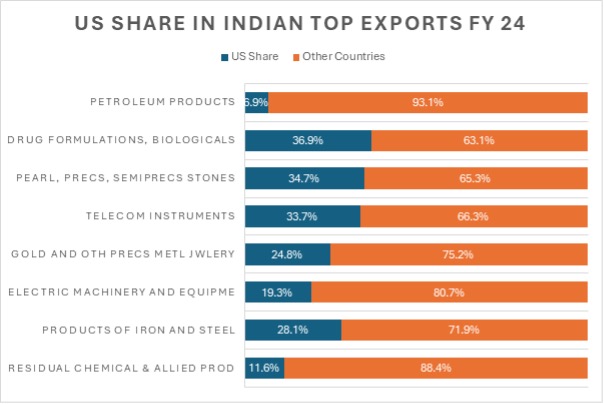

During FY 2024, the United States emerged as the largest destination for India’s drug formulations, accounting for 36.9% of total Indian exports in this category, valued at USD 8.0 billion. This underscores the critical role the U.S. plays in India’s pharmaceutical industry, which has become a key global supplier of generic medicines, vaccines, and biologics. India’s pharmaceutical exports to the U.S. have been driven by substantial regulatory compliance, cost-effective manufacturing, and a rising demand for affordable healthcare solutions. As a result, India remains one of the primary suppliers of essential medicines to the U.S., further cementing the robust trade ties between the two nations in the healthcare sector.

Beyond pharmaceuticals, the U.S. also significantly influences India’s high-tech and industrial exports. The U.S. accounted for 33.7% of India’s telecom instrument exports, valued at USD 5.8 billion, reflecting the growing demand for telecommunication and electronic products. Additionally, the U.S. imported 34.7% of India’s pearl exports (USD 6.6 billion), 28.1% of iron and steel products (USD 2.8 billion), and 24.8% of gold jewellery exports (USD 3.3 billion). These figures highlight the U.S.’s strategic importance in India’s diverse export portfolio, spanning critical sectors such as technology, industrial manufacturing, and luxury goods. The consistent demand for Indian gems, metals, and telecom equipment showcases the increasing diversification of India’s export base, reinforcing long-term economic engagement with the U.S. market. This diversified trade relationship ensures sustained growth and solidifies India’s position as a key global supplier in various high-value sectors.

Source: DGCIS, M/o Commerce & Industry

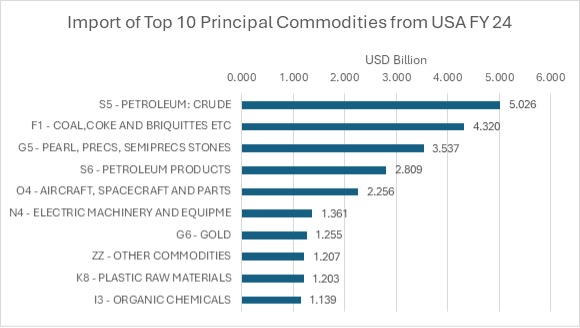

India’s trade relationship with the United States is not limited to exports; it relies heavily on U.S. imports to meet its growing industrial and energy demands. During the FY 2024 period, India imported USD 5.0 billion worth of crude petroleum from the U.S., positioning it as a key supplier of energy resources crucial for India’s expanding economy. Additionally, the U.S. accounted for 11.1% of India’s total coal imports, valued at USD 4.3 billion, highlighting its significant role in bolstering India’s energy security. India also imported USD 2.8 billion worth of petroleum products from the U.S., making up 7.1% of its total imports in this category. These figures underscore the importance of U.S. energy exports to India, ensuring a reliable fuel and raw materials supply to support key sectors such as industrial production and transportation.

Source: DGCIS, M/o Commerce & Industry

Beyond energy, the U.S. is critical in India’s import of high-value industrial and luxury commodities. India sourced USD 3.5 billion worth of pearls and precious and semi-precious stones from the U.S., accounting for 14.8% of its total imports in this category, reinforcing the U.S.’s importance in the Indian gem and jewellery industry. Moreover, the U.S. supplied USD 1.2 billion (7.3%) of India’s plastic raw materials, essential for manufacturing and packaging industries. Additionally, India imported USD 2.2 billion worth of aircraft, further strengthening the economic ties between the two nations.

The interdependence in trade between the U.S. and India underscores how the U.S. is not only a major destination for Indian exports but also a vital supplier of essential resources. This makes their bilateral trade relationship both mutually beneficial and strategically significant. India and the U.S. are working toward finalizing the first phase of a multi-sector bilateral trade agreement (BTA) by the fall of 2025, aiming to increase trade from the current $200 billion to $500 billion by 2030.

The growing economic cooperation and trade flows have bolstered commercial ties and deepened geopolitical relations. Beyond trade, the two countries are expanding cooperation across multiple sectors. The U.S. has partnered with India on its Semiconductor Mission, which includes plans to establish a multi-material semiconductor unit in India. Additionally, they are advancing a Next Generation Defence Partnership. The launch of the Transforming Relationship Utilizing Strategic Technology (TRUST) initiative will further enhance collaboration in key sectors like lithium, rare earth elements (REEs), advanced materials, and pharmaceuticals, further solidifying their strategic relationship.

Historically, agreements under the General Agreement on Tariffs and Trade (GATT) and the World Trade Organization (WTO) have allowed developing nations to maintain higher tariffs to protect their farmers and industries from the competitive pressures of industrialized economies. These tariffs prevent industrialized nations from flooding global markets with cheaper goods, which could threaten the livelihoods of poor farmers and emerging businesses in developing countries. These international frameworks recognize that developing nations face unique challenges that could hinder their ability to grow and compete globally.

Trump’s tariff announcement signals a shift from globalization towards increasing trade protectionism, raising uncertainty in international trade relations. This move could disrupt established trade flows and create uncertainty for economies like India, which depend on open global markets for growth.

Economic theory suggests that no country has an absolute advantage in producing all goods. Even if one country is more efficient in making everything, both countries can benefit from trade by specializing in what they do best and trading for the rest. A trade deficit or surplus reflects the relative strength of a country’s exporters versus its importers, but a trade deficit is not inherently harmful. For instance, when the U.S. imports more than it exports, it allows American consumers to access a wider variety of goods, often at lower prices. This is due to the competitive forces in global trade that drive down costs, allowing consumers to purchase products that may not be as efficiently produced domestically.

However, while this theoretical perspective underlines the potential benefits of trade imbalances, the practical implications for individual economies can be significant. Resolving this situation is crucial for India, particularly as it faces a considerable trade deficit. By the end of FY2024, India’s imports amounted to USD 678.2 billion, while exports were valued at USD 437.1 billion, resulting in a merchandise trade deficit of USD 241.1 billion. Instead of penalizing developing economies like India, which is grappling with this substantial trade deficit, industrialized nations, such as the US, should pursue a more sustainable approach. The emphasis should be on strengthening partnerships and increasing participation in global supply chains to promote mutual growth and stability.

Overall, open global trade drives international investment, fuels economic growth, and strengthens global supply chains by providing businesses access to a wider array of goods and services at more competitive prices. India is not only one of the largest markets for U.S. goods and one of the fastest-growing economies but also a crucial strategic partner with similar values on the global stage. The Trump administration must recognize that complicating India-U.S. trade relations would undermine their broader collaboration in other critical global spheres. Both nations must address trade issues constructively; only then can they fully unlock the potential for deeper economic and geopolitical cooperation.

The article was published with Open Magazine in the issue dated March 10, 2025.