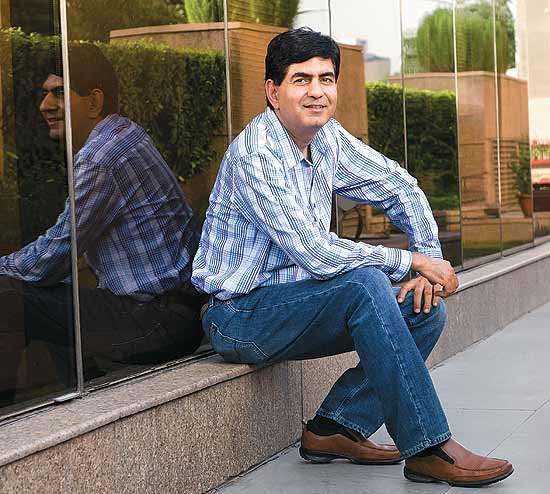

In an exclusive interview, Sanjay Verma, CEO, Asia-Pacific, Cushman & Wakefield, shares his insights on strategy, competition and challenges in the real estate industry with Dr Amit Kapoor, Honourable Chairman of the Institute of Competitiveness.

Sanjay, could you give me a brief overview of the real estate industry?

It’s probably the second oldest industry and largely a service-based business. There are predominantly five stakeholders. One category is occupiers of real estate—it could be a corporate occupier, manufacturer, an office, a retail outlet or even a warehouse. Then there are developers of real estate, who build real estate assets for the occupiers. The third category is investors, people who provide capital—they largely comprise various funds, financial institutions, sovereign funds, high net-worth individuals and corporates with surplus money. The next stakeholder is the government; the industry requires regulations and bylaws, so the government in every country plays a very big role. The last stakeholders are firms like us who act as advisors to occupiers, investors and developers or as intermediaries to these people to conclude transactions.

How has the industry changed in the last decade?

In India, not only the pace, but the quantum of change has been significant. Reason: until 1997, international players didn’t provide these services. Mainly, they were being self-performed by stakeholders or were being offered by extremely unorganised, unskilled players. In 1997, a few international people came in after FDI clearances. So, in terms of professional real estate services, the industry is only 20 years old; in the US or Europe, these industries have existed for close to 200 years.

You don’t want a Sebi, but you need a Trai kind of advisory body, which represents the whole industry.

n the early 1990s, the industry was not information-rich—a consulting business cannot really analyse or give suggestions without a mine of information. In the last 20 years, a significant change has taken place as we have the data now. Still, there are huge gaps because it’s a large country. But, as a result of information-led processes, stakeholders are becoming more aware of the overall impact of this asset class. The government is also realising that this is a very important piece in the overall GDP story, from growth as well as the development perspective. And the linkages with infrastructure make it even more critical for a country like India.

There are two more big changes. One, it is following a demand-supply pattern—demand by users, not investors, and supply by stakeholders—by developers. Two: real estate has been getting linked to other economic activities. If there is a general slowdown in consumption, real estate is getting impacted because there is only limited consumption capital. Compared to any mature market, one would say there’s still a lot to be desired. But the direction in which this is moving is quite noticeable.

What, according to you, is the correct way of valuation?

Valuation is a domain where only experts can give their views. But I’ll share with you the common terms. There are different ways of doing valuations. First, is by way of discounted cash flows, where you can find out if an asset will have an income stream or not. For instance, if it’s a hotel, you can assume its room and occupancy rate. Then, do the future cash flows, discount them back at an approximate cost of capital and arrive at a value. The only care to be taken is to have a significant history of data. In Hong Kong, you can forecast rental values based on future demand and supply, which is all clearly documented. In markets like India, that’s a challenge—there is no history of data. The second method of valuation is by calculating the replacement value [value at which an asset would be bought or sold]. Again, it can work in markets where there is a trading history. Third: assessing reported transactions, the frequency of transactions and the value at which deals are being struck. Basically, observing trends in the market. Again, that is an issue in India as most transactions go unreported due to little institutional activity. Adding to the problem is stamp-duty rates and non-transparency in the registration process. To sum up, it’s a challenge to arrive at the right method of valuation in India. Unfortunately, the government has also not addressed this issue—valuation guidelines, principles and licensing processes, which would have helped everybody value assets in the same way, do not exist in this country.

Could you elaborate on these set principles and guidelines?

By set principles, I mean standardisation. India is probably the only country of this size that doesn’t have a measurement standard. Here, every developer has his own (standard) and a new developer creates his own. Though the government is not required and industry bodies can do it, it is absent altogether. So, it gets exploited, which is not very investor-friendly.

So, I deduce that institutional support is also very weak. How do you think industry bodies could act?

Real estate doesn’t have an industry body, to begin with. I have been saying in conferences that real estate is the most over-governed or over-regulated industry and the most inefficient. The only challenge is bringing it under some federal regulation. Considering the contribution this industry makes to the federal economy, GDP growth and also to job creation, I think one has to relook at that. You don’t want a Sebi, but you certainly need a Trai kind of recommending, advisory body, which really represents the whole industry. To cite a case, the land reforms subject has at least 40 touchpoints between acquisition of land and construction on it. Now, these touchpoints breed inefficiency that results from leakages and corruption. So, this has to be reduced. Thus, a single body is needed that represents the views of all the stakeholders.

Which economy do you think has the best regulation?

The best that I’ve seen is Hong Kong. But that may not be the best example because it’s a city-state. The US has good room for everything. It works and protects the investor. During the global financial crisis, American banks overleveraged in terms of mortgages. But that was not the industry’s fault—that was when banks got adventurous. But, in terms of regulation, I think it’s pretty good. I even like the China model.

Back to India. Who is your competition?

There are three large firms and then, there are three or four not-so-large firms. The first three are global firms, and the next four are boutique local firms. Real estate is a local subject. Even in markets like the US, where there is huge maturity, you’ll always have a lot of boutique local firms that would have a market share of more than 50%. So, competition is traditional firms that compete with each other. Additionally, a lot of clients still self-perform—in countries like India, there are still corporates who think that they don’t need professional advice.

Customers being the determining force, how do you design value for them?

It depends on who your customer is. Value is measurable and one has to look at it from a long-term perspective. Whether you’re advising an occupier or a developer, if you’re not able to give them an analysis of the long term then you’re not doing a good job. Also, unfortunately, this real estate market—unlike equities or debt—sits with you for some time because the entry and exit process and even the cost is significant. So, you need an advisor: someone who can have a certain degree of foresight based on information. For investors, it’s even more important as most of the investors today are global and don’t have either the intention or the latitude to have their tentacles in every market. They need advisors who can give them quick information about how their investments will fare and about the demand and supply situation. Based on that advice, they take decisions to deploy capital. Thus, one can say that value addition is absolutely measurable, and if you’re not focused on adding value, you’ll go out of business.

Do you have a problem of industry convergence wherein everybody is trying to follow the same strategy?

Certainly; that’s a natural progression for any industry, in any market. But I believe that it won’t be the case in the long run because, unlike in the commodity business where you cannot add value beyond a point, in the services industry, the approaches people will take in different firms or competitions will be different. You could just think of an out-of-the-box idea and you don’t have to go for a patent. And suddenly, you’ve got a differentiation. To some extent, it will happen not because of the competition but due to the maturity of the market.

We’re in the business of providing advice to our clients so that their decision-making related to real estate assets adds value to their overall business. It will vary from market to market. In India, nobody knows what is available because there are no public databases, so even that is an offering. Even the information about availability of assets is a value-add. In Hong Kong, it has to be de-structured and be a five-year plan. One’s knowledge of the government’s plan, the next big wave, how much capital is coming in, how demand and supply is resulting in a change, is the value offering. So, convergence happens not because of the player but because of the maturity of the market.

And how do you differentiate assets?

For Cushman and Wakefield, the differentiation basically comes from the clients. Having maximum dots on the map doesn’t work for us. What we want is to continuously provide creative solutions and do more business for the same clients. We have a very nice combination of a global firm with a global fabric and a degree of entrepreneurial streak in each of our businesses. This lends us flexibility to offer more than a cookie-cutter solution everywhere. We can do that because we’re the only large, non-listed firm, and that has been our strength. We don’t have to really deal with a quarterly conference call to tell investors what all we are doing for their welfare. This helps us take a long-term outlook.

Very interesting! So how do you see consumers changing now?

Our consumers range from the government to a corporate occupier (any of the Fortune 500 companies) and even an investment bank. Occupiers are changing; when we came to India, occupiers were very sceptical about everything in the market as they had heard that the system is corrupt. To a significant extent, we’ve seen a shift. In none of the deals do we have to deal with cash and, fortunately, we’re not in the residential markets. There are still issues and concerns that have to be dealt with, but largely corporate occupiers have become more comfortable with the quality and consistency of service along with the capability of the players.

In terms of developers, it’s been 50-50 as some have a blinkered approach and think this is de-coupled from other industries and the economy. But in general, large established players have understood that if this industry is growing, it is mostly doing so on the principles and phenomena of other parts of the world. And, they’re willing to leverage best practices from around the world.

What are the challenges for you as a firm right now?

I think the biggest challenge remains talent because this is largely a people-based business. And in India, unfortunately, universities don’t offer courses in real estate. So, here, we have to do a lot of hit-and-trial in terms of getting talent. Our growth targets are quite steep but we are not able to meet that expectation because we can’t find enough people with the quality we want. Scarcity of talent also creates volatility in the job market as a sudden boom in the industry makes it difficult to retain the limited pool of labour. On the government side, there are certain issues that the government can address by just bringing standardisation.

As a firm, you must have decided not to do a few things. What are those things?

In India, we’ve decided not to be in 20 cities. We have nine offices and I think they’ll remain nine offices for the next two to three years. I’m not saying there is no opportunity in those cities… but our firm lacks the knowledge of those markets. We are extremely fearful that we might damage our brand name by entering them with no prior knowledge. There are also some businesses that we have decided not to get into. And that is again because we feel that maturity in those businesses is still far from what it should be. We have also deliberately kept ourselves out of mass residential businesses. It’s a huge opportunity; some of our competitors have teams of 100 to 200 people sending SMSes to retail people asking them to buy and sell property. But our company would never go into that segment.

Sanjay, if I ask you to define strategy, how would you do that?

You’ve got to address three principle entities when you define strategy: your shareholders, your people and your clients. Any strategy that is not addressing either the concerns or the aspirations of these three elements will not be implemented. If you don’t have the capability of hiring the right people to address a market; or if your clients are not supporting you; or if your shareholders don’t appreciate the challenges and needs of that market, you may fail. Most parts of our strategy flow in from either the aspirations or the capabilities of these three elements. So, as long as you’ve addressed that, I think you’ve got a good strategy.

What about leadership?

Leadership is a tactical response to the strategy. Once you’ve developed your strategy, you have to have the right organisational structure: the leadership and the reporting structure matrix (centralised or globalised). Then, you have to address internal infrastructure issues: what technology and processes you need. And then, you have to match it with the external infrastructure: how do you interface with the markets. Leadership and the infrastructure issues are a response to your strategy.

Is there anything more you can share with us?

Being in a services business is fun because there are few written rules. You can be a game-changer far more often than you can be in a product-based business, especially in markets like India, where you don’t have the baggage of market maturity. I don’t believe in status quo—we’re about innovation and creativity. As these markets become more mature, firms that want to do more of the same thing will have survival problems, and some of them are having that at a global level right now.

4 CS Model

Context

- Paucity of talented workforce

- Absence of standardisation from the government’s side

- Scarcity of market-related information

Competition

- Traditional firms, global players and self-performing clients

Company

- Striving to create value for customers

- Concentrating on providing creative solutions to clients

- Restricting itself to a limited set of markets

Customer

- Ranging from occupiers and corporates to investors and government

- Global and local

- Demanding services accompanied by returns

Evolution of the Industry

Wave 1

- Overtaking of self-performing stakeholders.

Wave 2

- Capture and compilation of market-related information.

Wave 3

- Industry following a demand-supply cycle and also linking to other economic activities.

CEOs across India speak on strategy and leadership, in an exclusive series developed jointly by Outlook Business and the Institute for Competitiveness. The StratSpeak interaction was published with Outlook Business on April 2, 2011.