By Amit Kapoor and Sheen Zutshi

EU-India Potential FTA: For Shared Prosperity and Strategic Resilience

India and the European Union (EU) are the two major economic powerhouses that are right now working together to recognize the immense potential of strengthening trade and economic cooperation. This is driven by reignited fuel to conclude negotiations for a Free Trade Agreement (FTA) between the EU and India by year are underway. EU and India are driven by mutual strategic interests and recent shifts in the global tariff war triggered by recent decisions by the US government.

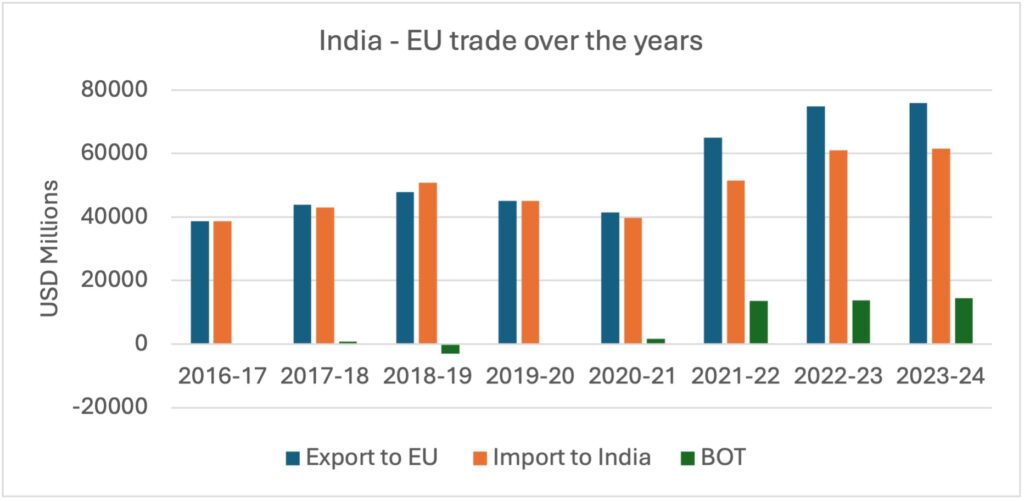

Trade Dynamics illustrates a positive trajectory for India and the EU, underscoring how a comprehensive FTA could play a transformative role. It could strategically position both partners to navigate complex global trade challenges while fostering a deeper exchange of cultural and diplomatic ties. India’s trade with the EU has witnessed remarkable expansion over the last decade. The Ministry of Commerce Dashboard data reveals that Exports from India to the EU have nearly doubled since the fiscal year 2016-17. They rose impressively from USD 38,768 million (excluding the UK) in 2016-17 to USD 75,937 million in 2023-24. Exports dipped during the COVID-19 pandemic. However, trade has bounced back rapidly and has been increasing since 2021. The recovery must also be seen because India has no longer faced a trade deficit with the EU since 2019-20. The balance of trade has shifted positively.

Source: Ministry of Commerce Dashboard

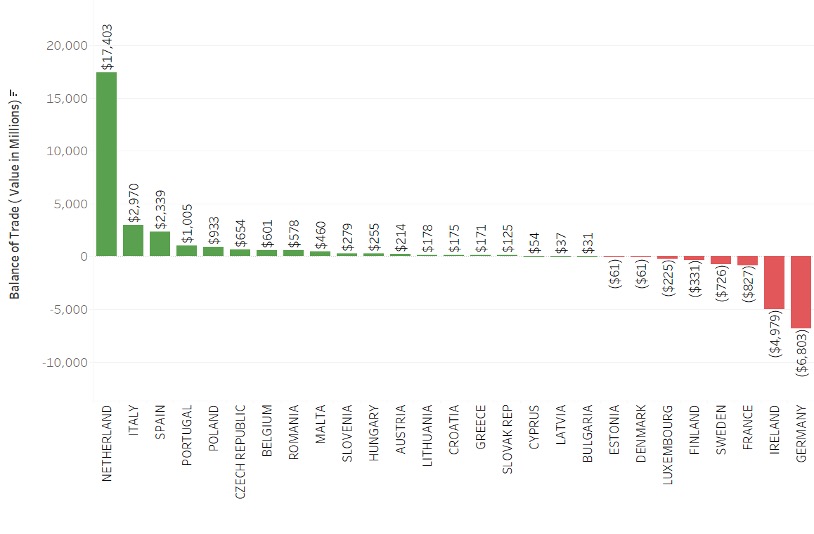

India maintained a trade surplus with 19 out of 27 EU member countries in 2023-24. Countries like the Netherlands, Spain, Italy, and Portugal account for the most significant trade balance of trade surplus, reflecting India’s increasing reach and competitiveness in these markets. However, this doesn’t necessarily indicate a complete picture of the EU as a whole, as other EU countries, such as France, Germany, and Ireland, have significant trade deficits with India.

Source: Ministry of Commerce Dashboard

Commodity Mix Driving India-EU Trade

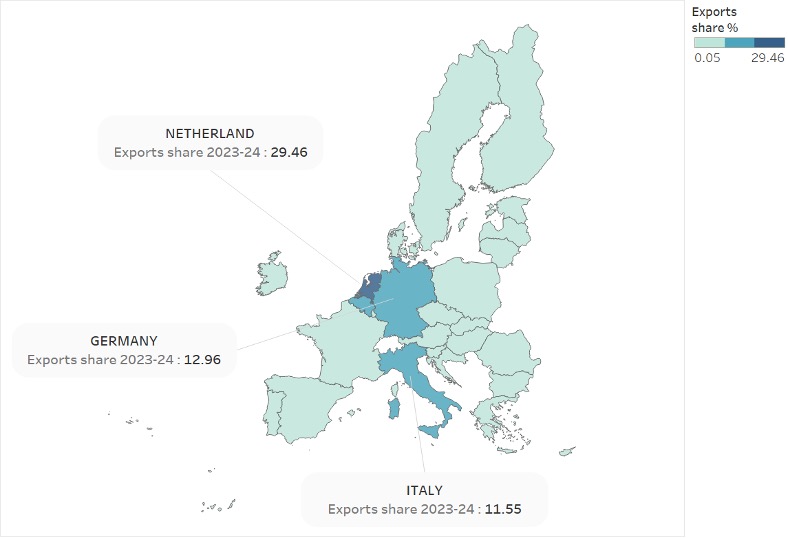

Before delving into what commodity basket drives EU countries’ trade surplus and deficit with India, it is crucial to understand their internal Trade Dynamics in the context of India. In 2023-24, more than 53.96 percent of EU exports to India are predominantly from just three countries: the Netherlands, Germany, and Italy, with 29.46, 12.96, and 11.55 percent, respectively.

The balance of India’s trade surpluses with the EU is particularly pronounced across commodity groups: textile products (USD 6,170 million), pharma products (USD 2,296 million), and agricultural commodities (USD 1,958 million). Among the broad commodity groups, the top 10 principal commodities account for over 58 percent of India’s exports to the European Union, highlighting India’s export strengths. These commodities include petroleum products, iron and steel, ready-made garments (mainly cotton and related accessories), drug formulations and biological products, and processed iron and steel products.

Upon further examination of India’s top 100 export basket to the EU, it is noted that India’s trade with the EU emphasizes areas of substantial competitive advantage. The dominating export basket is reflected in Mineral fuels and products, which in 2023-24 were valued at USD 19,196.30 million with an annual growth of 22.85 percent. Due to India’s substantial refining capacity, these dominated 25 percent of India’s exports to the EU, primarily refined petroleum products. Due to its strategic importance in Europe’s energy diversification efforts, the nation is a key supplier of petroleum-based products to international markets of EU countries.

Electrical Machinery and Equipment ranks second at USD 7,966.76 million with 2.43 percent annual growth, indicating India’s growing capacity in electronics manufacturing, partly driven by global supply chain diversification trends. Other notable exports include Nuclear Reactors and Mechanical Appliances (USD 5,240.14 million, 2.42% growth), Organic Chemicals (USD 5,012.48 million, -11.05% growth), and Iron and Steel Products (USD 4,692.39 million, up 14.2%). These commodities underline India’s traditional strengths in heavy industry and chemical sectors, which are critical to Europe’s manufacturing and industrial inputs.

Pharmaceutical products, another significant export commodity, stood at USD 2,878.65 million with an annual growth rate of 5.95 percent, reinforcing India’s global leadership position in generic pharmaceuticals and biologics, particularly post-pandemic. On the other hand, however, Articles of Apparel and Clothing exports saw negative annual growth of 6.82 percent, indicating potential challenges in textile market access or changing consumer preferences towards sustainable and circular fashion in Europe—a vital strategic opportunity for cooperation and innovation under the proposed FTA.

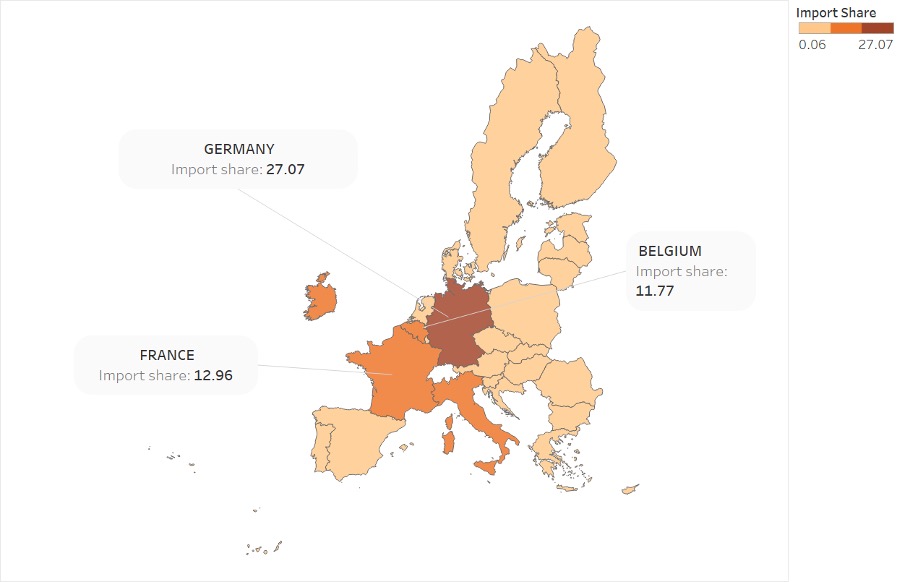

After Examining India’s Exports to the EU, we focus on the EU’s export dynamics to India, which further sheds light on India’s strategic dependencies and underscores the challenges and opportunities for deeper economic cooperation within the broader framework of the proposed Free Trade Agreement. In 2023-24, Germany, France, and Belgium significantly dominated EU imports into India, with 27.7, 12.96, and 11.77 percent, respectively, representing more than 50 percent of total EU exports to India. These trends further imply the potential for deeper engagement of other EU countries to be embedded through a broader EU-wide framework for trade with India.

Source: Ministry of Commerce Dashboard

Upon further examination of the Top 100 imports from the EU to India, the reliance on high-value-added industrial and technological products is observed, underscoring India’s current dependency on European technology and capital goods. Among the top imports in the fiscal year 2023-2024, the highest was nuclear reactors, Boilers, Machinery, and Mechanical Appliances at USD 12,901.35 million with annual growth of 17.19 percent, followed closely by Electrical Machinery and Equipment at USD 10,227.03 million with a significant annual growth rate of 35.49 percent. The substantial imports of aircraft and spacecraft parts at USD 5,446.31 million, which is 13.76 percent of the yearly growth, further underscoring India’s dependency on advanced European aerospace technologies. Overall, India’s Import basket from the EU demonstrates a strategic economic dependency on Europe’s sophisticated manufacturing, technological innovation, and precision engineering, which originates mainly from Germany, France, and Belgium, countries with advanced technological capabilities.

Overall, the import and export trends of the EU and India reveal a complex picture in finalizing FTAs due to the interdependent trade relationship, underscoring opportunities and vulnerabilities. India’s pronounced import dependency on high-tech and capital-intensive European products suggests implications for the Indian economy to make moves on further advancing domestic production capacities, incentivizing European investments, and fostering technology transfer through a robust FTA framework. This is also reflected in the export basket, making it imperative for India to transition from upstream raw material and intermediate goods production to downstream, high-value-added activities, including brand ownership and sustainable production practices. Leveraging India’s cultural heritage in textiles and pharmaceuticals can elevate Indian brands directly into European consumer markets, fostering cultural exchange and economic enrichment.

Similarly, India’s future electric mobility goals, circularity in the textile market, and push towards EVs and reducing petroleum dependency align with Europe’s technological expertise, R&D strengths, and growing automotive industry. By leveraging complementary advantages, both sides can foster partnerships that drive mutual competitiveness and facilitate technology transfer, infrastructure investments, and co-developed market access.

A well-structured Free Trade Agreement could this integration by providing intellectual property protections, improving market access, and supporting Indian brands in their transition from being mere suppliers to becoming internationally recognized fashion innovators. For instance, India’s rich textile heritage, diverse cultural narratives, and traditional craftsmanship can significantly engage European markets through effective branding, strengthening quality control, design innovation, and sustainable practices. This would further underscore the significant opportunities to deepen trade, facilitate cross-country partnerships in technology transfer and investments in sectors such as the circular textile industry, electric mobility, rebalance trade deficits, and strategically leverage cultural exchanges.

The recent protectionist shifts in global trade policies exemplified by the recent move of the US government via reciprocal tariff strategy and the strategic need for regional agreements can force countries to recalibrate their economic partnerships, perhaps making the timely conclusion of the EU-India FTA imperative for both parties. The timing is perfect. By reducing dependence on volatile external markets, an FTA between the EU and India could serve as a resilient anchor, shielding regional economies from external shocks and helping enable a stable trade environment.

As negotiators from both sides aim for finalization by year-end, we hope both regions of the EU-India stand ready to chart a course towards a resilient economic partnership to ensure long-term mutual prosperity, strategic resilience, and cultural enrichment for India and the European Union. The successful conclusion of the EU-India Free Trade Agreement would not only symbolize economic integration as it embodies a strategic alliance poised to strengthen the geopolitical collaboration of both regions, but Robust trade statistics can validate the potential of regional trade agreements in an era defined by global economic volatility. This could further underline the mutual benefits of deeper economic integration and powerfully reaffirm the strategic necessity and potential resilience provided by ambitious Free Trade Agreements.

The article was published with Open Magazine on March 21, 2025.