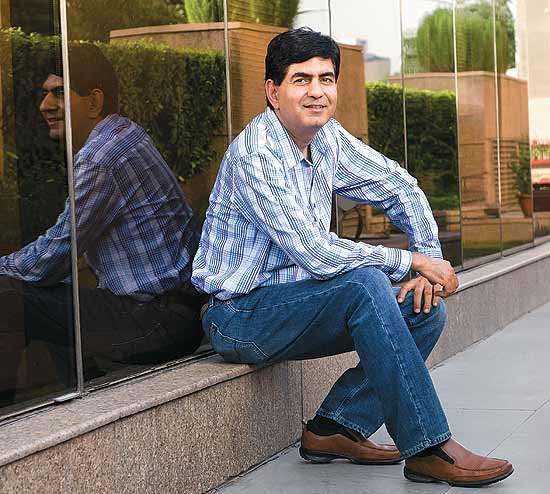

Niren Chaudhary, Managing Director, Yum Restaurants, India, offers unique insights about the restaurant market especially ideas pertaining to value, in a chat with Dr Amit Kapoor.

Can you give me a brief overview of the eating out market?

The size of the food market in India is about $90 billion and out of this less than 2% is thought to be catered to by organised brands like KFC, Pizza Hut, McDonalds, Dominos, and so on. The organised brands constitute just a fraction of the entire eating-out market, though this is where the activity takes place with growth rates in excess of 30% annually.

Given the context of the Indian economy, eating out is obviously a very attractive sector for new brands. There is a huge rush of all kinds of concepts like affordable casual dining concepts (Pizza Hut) and quick service restaurant (KFC, coffee chains), etc. However, at this stage, there are only a handful of establishments with a proven business model and these ones are beginning to scale up. McDonalds, Domino’s and Yum! Brands are growing.

We have had a breakthrough this year where our collective growth with all of our brands is going to be in excess of 100 stores with a total of close to 400 restaurants in India. So we are sure that it is a very big, organised opportunity with humongous growth potential.

In India, eating out is about enjoyment and entertainment. Would you agree?

The eating-out market (eating out of home) is primarily about a social occasion wherein people normally go out in much larger groups than they do otherwise. Seventy per cent of the people who go out shopping or for other purposes actually eat out as well. People eat out predominantly for social reasons.

What are the other insights you have gained in India?

A few insights shape our strategy in India.

The first insight is that India is all about youth. The Indian youth aspires more, consumes more, wants more, and is also a lot more open, as is the nature of youths, to new ideas and new concepts. This implies that for any brand to really succeed, it has to be youthful, aspirational and

innovative in what you do.

The second insight is on value, which is a key gate-opener as we go down the income pyramid.The third insight is on focus, and this means that it is very tempting and easy to get mesmerised by the market figures [nearly a billion people]. We need to clearly understand who can afford our brand and where they live. A hundred million customers who can afford our products are spread across various metros and cities. Even if they live in the same city, they’re spread over different parts, so you need to have a focused strategy on which cities to get into, and then what areas in those cities are ready for your brands. You must also make sure that there is a very good sequential approach to the way you build the brand so that you’re bringing the brand to life at the time that the consumers are ready for you.

The fourth insight is in the paradox of global costs and local affordability. Success in India is a very unique cocktail of costs—i.e., rentals, infrastructure, generators, supply chain etc—and affordability, i.e., customers are value driven.

We will primarily remain an urban concept and we will be pushing urban penetration to the extreme.

Your emphasis has been on value. Tell me more about that.

In India, value has many definitions and different definitions depend on where you are in the income pyramid.

If you start right at the top, you have called the money value, which is something like, “I have the money, if you have the right products. So give me the best, and I’m willing to pay for it.” The second one is value for money, which is the classic what I get for what I pay.

The third one is good enough value, which is, “don’t give me all this stuff about brands. As long as it works, has got the functionality then that’s good enough for me.”

The last one is price point value and this is where the income affordability pyramid explodes. The price point value is “I have only Rs 20, tell me what you have as I’m not willing to spend any more.”

India has a high cost environment. How does this challenge business thinking?

You have a high cost environment in India with low affordability on the consumers’ side. This, in turn, squeezes the margins and it has an impact on the business model. To be successful in India we need models with modest margins and high asset efficiency. What this means from the income side is leverage, sweat the asset as much as you can, i.e., open your restaurant for breakfast, for pre-lunch, for lunch, post-lunch, evening and then late night. On the costs side, it is get more efficient and productive at whatever you’re doing.

Yum Restaurants, Pizza Hut and KFC are all successes in fusion cooking. How did you hit upon the right idea?

This is a very important question that seeks to answer how far do you localise, and how far do you stay international? We have realised that we are going to look for what is similar across markets and regions to construct a concept that is fundamentally international.

Did Indianisation help?

We have made some key changes in our offerings. We’ve introduced a vegetarian line, added sprinkle flavours on some core products like Hot Wings and so on, because we know that the Indian palate likes a little more kick to the spice and the flavour than the international customers would want. Though the core recipe remains the same, we’re accentuating some of the flavours based on our understanding of the Indian palate.

We’ve Indianised on the fringes with offerings such as rice, which we don’t have in many markets. The curry here is localised, which actually complements the international product. A good way to visualise our concept would be that the central item is international, and then you have some accompaniments that are local. We have stayed true to our core identity so that the consumers understand us, and the reason for them to come to us is that what we offer you can’t get anywhere else.

Who is your competition and how do you look at the competitors?

My belief is that there is actually no competition as the market is large with a distinct possibility for all formats to coexist.There are reference points for all our categories and our vision is to be the best restaurant company in every category in which we operate. We basically talk about three categories: one is what we call the affordable, casual dining segment where we have Pizza Hut, quick service which is KFC and Taco Bell, and then we have home service where we have Pizza Hut Delivery. In the casual dining segment, there are no organised players, Pizza Hut is the largest and brand there’s no other national player with the same footprint.

In the quick service segment where we have KFC and we have Taco Bell, we have McDonalds in the same space, who’ve also been there in the market for the last 16 years. On the home service side, we have Domino’s and Pizza Hut Delivery.

We’ve added sprinkle flavours because we know that the Indian palate likes a little more kick than the international customers.

Will you remain an urban concept?

Certainly. We will primarily remain an urban concept and we will be pushing urban penetration to the extreme. We will have close to 100 KFC restaurants in the next four years in comparison to 30 now.

For KFC, we’re currently in about 30 cities, we want to be in 100 cities in the next four years. Our ambition is to go as far as we can. We have been very encouraged over the last two years with the success we’re getting in emerging cities. Incidentally, we’re getting the highest sales from cities like Coimbatore, Calicut, Goa, Vizag, Mangalore and so on.

Your success rides on site selection. What principles do you follow?

We actually get to learn from what has happened in other markets. The learnings remarkably increased the probability of success of our decisions and, therefore, we apply a lot of thought to that process.

We have various formats that we can expect because the desire is to also make our brands very conveniently accessible to our consumers, so we will have high street, malls, IT parks, business parks, drive-through, airports, highways and so on. Different formats have different criteria that can help us predict the success of those formats.

We have a very exacting process and, as one would expect, we have many variables that we try and optimise. We have a pretty rigorous process for site selection and it is a complicated science. So, first we look at which cities we want to go into, second which trade areas do we want to venture into and then, within that trade area, what site do we want to go after.

You have told us about the formats that you venture into. Will they be company-owned, or will you also go for the franchising route?

It varies by brand. For Pizza Hut restaurants, it’s primarily franchise, and we’ll stay with that; Pizza Hut Delivery, which is the home service aspect, we’re also going to be building our own stores; KFC is half and half, we’re building half and half is being built by franchisees.

Our goal by 2015 is to be a billion-dollar business with 1,000 stores, and 50,000 employees. Out of those 1,000 stores, at least 500 will be KFC and 500 will be Pizza Hut in various forms. So we see franchisees as being key partners in helping us drive our growth agenda, and they’ll be driving at least half of what we’re doing over the next few years.

A few companies dumped the franchisee model soon after penetrating the city market. How would you react to this proposition?

We are a company that has built a value system around franchisees—which is that we value them as our business partner. That’s our mindset. It is not a transactional mindset. Globally too, if you look at Yum!, we’re almost like a 75-80% franchise system. Therefore, franchising for us is a very important way to execute the brand and one that does very well. So, I see us growing in partnership with our franchisees who will help grow these brands to their full potential in the next four or five years.

You must have a super-efficient supply chain to survive. What are the processes and steps you took to create the supply chain?

Basically, the two biggest areas of sourcing in our system are cheese and chicken. Depending on the geographical distribution of stores, we look at how we are going to source our ingredients as efficiently as possible, so from suppliers’ factories through primary transport to warehouses, and then from warehouses through secondary transport into the cities where the stores are located.

We have conducted a major exercise and actually thought through how supply chain and logistics will enable this growth from 30 cities to 100 cities. We have been encouraged to find warehousing, which is essentially dry warehousing, shared and frozen warehousing, as also ambient trucks and frozen trucks. The capacity in India is unorganised but there are sufficient numbers to more than take care of our needs.

What is strategy?

I think strategy for me is having a clear understanding of where you are, a clear ability to envision where you wish to go, and then strategy basically helps you move from day to day.

4Cs Model

Industry Dynamics

- Huge market size that is growing at 30% annually.

- Focusing on Tier-1 and Tier -2 cities.

- All kinds of eating concepts are widely acceptable.

Positioning

- In the service segment, caters to three categories.

- Exhibits an urban concept.

- Outlets are easy accessible.

Trade-offs

- Brought in the concept of fusion cooking.

- Flavours based on Indian palates.

- International cuisines are Indianised.

Fit

- Franchisees are a big support.

- Strong supply chain.

- Organised opportunity with humongous growth potential.

Insights

- India is all about youth.

- Value is a key gate-opener to tunnel down the income pyramid.

- Focus on the right customers.

- Paradox of global costs and local affordability.

Values

- Money value: Ready to pay but want the best product.

- Value for money: Pay as per the product’s worth.

- Good enough value: Concerned about the functionality of the product rather than the brand name.

- Price point value: Not willing to spend extra money.

The Strat Speak interaction was published with Outlook Business on November 26, 2011.