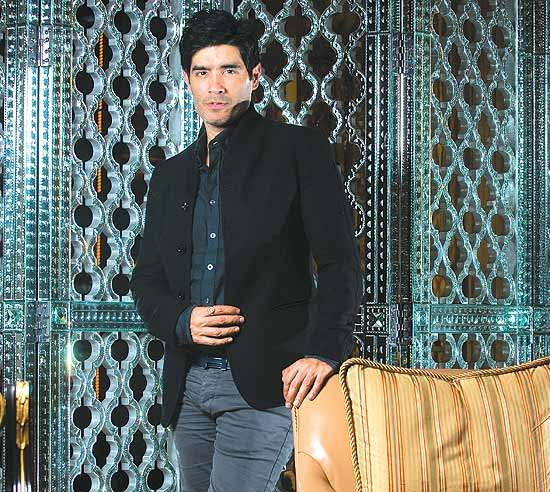

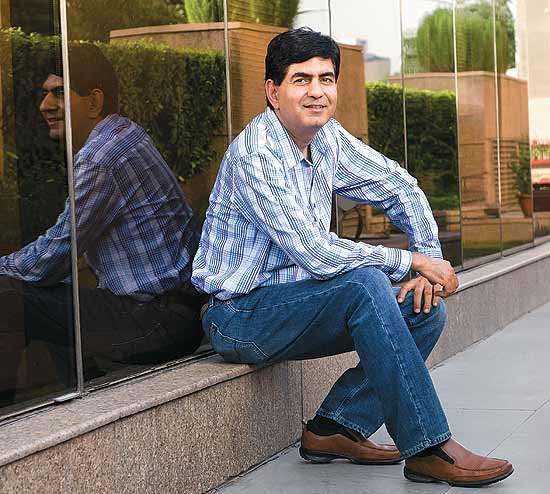

Anoop Prakash, Managing Director of Harley-Davidson India, explains the iconic motorcycle maker’s India strategy to Dr Amit Kapoor, Honorary Chairman of the Institute for Competitiveness and Professor of Strategy and Industrial Economics at Management Development Institute.

You entered India sometime in August last year. What are some of the challenges you faced in this new market?

There is always trepidation when you are entering a new market because you have to select new partners, dealerships, etc. Your objectives might be the same, whether you are entering India, Russia or Brazil, but the local conditions and local business practices are different in every market. You need to have local knowledge combined with your global aspirations in order to succeed.

When it comes to local conditions, the challenge is in understanding the business environment. For us, understanding the business environment in India meant seeing what kind of success pre-existing dealers of premier vehicles have had, and understanding the dynamics of the Indian retail industry because we also sell apparel and general merchandise.

What points of differentiation has your research shown between the US and Indian markets? What were some of the key learnings?

I think some of the key learnings are what problems the rider faces when using a two-wheeler on the road and traffic conditions in one place versus another. In the US, you have a highway system, and this has driven the adoption of motorcycling as a major sport and touring activity. In India, there is a lot more interest in riding in the city from place to place, but there is movement towards a touring culture.

The feedback from customers has been that there are narrow lanes in certain places, and we need more manoeuvrability, better suspension and more ground clearance. This is something all designers working for the Indian market have paid attention to, and we are taking great care of this in terms of the models we have brought to India. We have a portfolio of 40 Harley-Davidson models in the line-up; we chose 12 this year specifically because of the feedback we received from the customers. As we move forward, we will continue to emphasise the development of those accessories and bikes that are going to be successful here.

I think getting to relevance is a major part of strategy. Without relevance, you will always get stuck on the point of value proposition. You can talk about financial value, resale value and brand value, but unless you have a high level of relevance for the product that the customer sees, the value is going to be superficial.

Harley-Davidson’s 4Cs

Customers

- Familiar with the two-wheeler

- Aspirational and status-conscious

- Want brands that allow self expression

- Want the renowned Harley experience

Competition

- Not product-to-product

- Any leisure activity

Context

- Myth about difficulty in riding bikes and Indian roads

- Building a touring environment

- High import duty/ tariff structure

Company

- Use bikes as brand ambassadors

- Use experience to create accessibility to product

- Setup CKD assembly facility

- Ability to educate customers

The Indian mentality often revolves around kitna deti hai? (how much [mileage] does it give). Has this been a concern for you?

Yes, you stop at the toll plaza and you have a bunch of people looking at you from cars, asking you the same question, “how much did that bike cost and what is the mileage?”

I think it’s a fair question. It is a part of the education process. What it really comes down to is relevance. If someone is asking about mileage, it is because they have been taught over time that this should be most relevant point when buying a car. There is nothing else to differentiate cars, as they all look, feel or cost the same. If you build relevance in other areas, like the actual design of the machine, the self expression you can display, the ownership experience or camaraderie, then you are not worried about the mileage any more.

I think We are squarely in the category that nobody needs, but customers buy our product because they “want” it.

Your bikes come across as an ego-expressive product. How do you look at the consumer base here?

I think we are squarely in that category that nobody needs, but customers buy it because they “want” it. This is a product that you want and you think about at night when you sleep, and it’s an experience you look forward to over the weekend. People have this misconception that our bikes are just for Bollywood stars and cricketers, but if you look at our first few hundred customers, they are in their late thirties or forties or they are executives who already have a car at home. The bike is exclusively for them, they have earned it, they have provided for their family and they deserve a little bit for themselves.

At the macro level, we wanted to get everyone excited about India. We made investments in India because there is a lot of enthusiasm about biking here. People are familiar with how to ride a two-wheeler, which alone is a huge advantage compared to some other markets. You have an aspirational and status-conscious consumer here. This bodes well for a lifestyle brand of any kind. I think the market is less price-conscious and more value-conscious, and Harley brings a value proposition to the market. For us, a big part of our emphasis has been educating our customer on our value, as opposed to manipulating our price.

Strategies For Success

- Present the global experience in India

- Bringing relevant products to the market

- Adding value—price and accessibility

- Developed a strong relationship with ICICI

- Getting supply and manufacturing chain in order

What is this value proposition that you present to the customer?

Our brand has been differentiated over the years with very specific strategies. Every motorcycle has a unique combination of looks, sound and feel, which make it possible to recognise a Harley-Davidson from a mile away. This has been our style and design from the early sixties onwards. The other side of it is that there is an ownership experience we create that is unique around the world—the Harley’s owners group, and lifestyle that they experience being a Harley owner is a major differentiator for us and something we are investing in heavily in India.

Has it been a company strategy to create this cult around the brand?

It’s a good question, one that can probably be better answered by historians than me. What I have observed is that the cult, as you call it, is very organic to the customer base, but is encouraged by the way we’ve structured our relationship with our dealers and customers. We are very proud of the fact that we ride with our customers. We are not a bunch of suits sitting in an ivory tower taking decisions on product and design, without actually riding our product. This philosophy has engendered our customer’s love for the brand as well as the camaraderie and special membership that a Harley owner has.

You can talk about financial, resale and brand value, but unless your product is relevant to the customer, the value is going to be superficial.

How is the consumer changing? And how is this change bringing opportunities or challenges for you?

Indian consumers are well informed, and we have to realise that we cannot differentiate between what we deliver to our customers here versus anywhere else in the world. Harley-Davidson has to deliver the legendary world-class experience that Indians have read and heard about. I think it is safe to assume that the customer is not going to expect anything less.

Customers here are very eager to acquire brands they can express themselves with. The self-expression component is now starting to evolve. Initially, there was a surge for getting hold of the brand because there was a brand. There is a change in the customer mindset and they know that there are many brands to choose from that match their lifestyle and desire to self express.

Would you categorise Indian Harley-Davidson customers as just brand-conscious or as brand-loyal?

You are moving from people who are brand-conscious but not necessarily brand-aware, to people who are brand-aware and slowly becoming brand-loyal. You may reach a point when you have someone who is just all about the brand, no matter what. In addition, we found out that there are Harley owners and enthusiasts who had been waiting for us to come to India for many years. They were well entrenched into the brand long before we got here.

Strategy Demystified

What are the most popular myths that you generally fight?

There are many myths about motorcycling in general. There is a huge myth about the difficulty of riding. In the US, you’ll see four-feet-tall grandmothers riding the biggest bike we sell, and they manoeuvre them like professional police officers. It’s just unbelievable to watch, but made possible by the technology and design of our bikes. The ergonomics can be changed and shifted for any body type or height.

The other myth is Indian roads. Some people say it’s a fact and not a myth, but I think it depends on where you are and also on what you are trying to do. If you had to do your daily commute on a two-wheeler, which a lot of people in this country do, it’s not a lot of fun. If you go on a weekend ride, get on a highway, open up the throttle and get onto some smooth ground, it’s a completely different experience. There is immediate focus on the road right outside your front door as opposed to the roads that need to be explored.

How big do you think the market is going to be for you in India?

We are entering this market as the first real serious entrant in the heavyweight space. We are accessible to a broader set of enthusiasts and we are creating a modern category of riding that we call leisure riding. It is not about riding from point A to point B because you have to, but about where you want to, when you want to, with whom you want to ride. It’s a completely different mindset. For us, it’s evolving very nicely in the sense that people understand it, and they are looking for things to do in their leisure time.

Who do you see as your competition in the Indian market?

Honestly speaking, competition for us should not be thought of as product-to-product. Our own ability to educate our customers is a hurdle and is competing with us. All those things that an individual does in his or her leisure time is our competition. A lot of people play golf for their business pursuits, some people like to travel, but there is always one activity that you do for yourself, and that is the one activity we are competing against—what people do in their spare time, for their entertainment or self-fulfilment.

For instance, for my mother it would be touring India and visiting temples. It’s more a matter of finding those pursuits that reflect yourself. I think what is nice about our value proposition is that every owner has an opportunity to express himself differently.

Is spirituality your competition?

Well, I think everyone finds their spirituality in their pursuits. I think that’s the driver. It is truly about helping someone get to a point where they are able to engage in self-expression. When you pick the motorcycle that fits you and go to the place where you like to go, ride with the people you want to ride with, it is the ultimate form of self-expression. The experience is about your choices as opposed to choices that other people are making for you. This is the freedom of expression that comes with the act of leisure riding.

What is the company doing in India to ensure success?

The customer experience that we deliver across the world is our greatest strength. The second would be about bringing a relevant product to the market—getting to the point where we are delivering the most applicable products for Indian riders. The artificial taxes on the bikes might keep people away. But, we have developed a strong retail-financing relationship with ICICI. We worked with the bank to understand our long-term strategy, and this was important to get people over the price-value dilemma.

What do you mean by artificial taxes?

Artificial is my choice of words. It’s effectively the tax that puts this pursuit out of reach. In the US, we sell a bike at half the price of what we sell it here. It is more accessible there than in India and this is what tariff structures do. For me, it’s an artificial barrier. A true enthusiast would get into the brand under any circumstances, but we have this new barrier in front of us that we have to deal with.

Are you doing anything else specifically to increase accessibility?

I think it is not just awareness of the brand through basic education or advertising, but about experiences. Our bikes are our brand ambassadors. Our dealers invite people to take a ride, and get a taste of that freedom and self-expression. The experience is a very important part of accessibility, because if it is something that you have just heard or read about, you cannot describe it.

This is an important part of our strategy—making sure that people are accessing the experience so that they can make a truly informed decision about whether or not to make a purchase.

Manufacturing is an important part of controlling quality and design. How does it fit in the total value chain?

Recently, a lot of manufacturers have flipped their model upside down—rather than starting from existing platforms and what can be built from that, they start with new customers, and what they want and can pay. This is what Tata did with the Nano and what others are forced to do if they want to crack emerging markets.

The second part of it is making sure that you have a reliable supply chain and are able to meet the market demand. In a hot market like India, finding suppliers and having the right capacity is going to be challenging. We have recently announced that a CKD (complete knock-down) assembly facility will be operational in Haryana in the first half of 2011. CKD assembly operations are a natural next step for Harley-Davidson as we increase our ability to meet the needs of India’s consumers. This will help us increase our market responsiveness and production flexibility, while reducing the tariff burden.

What is your vision for India in the next 10 years?

For me, India should be one of our top two markets in Asia. We should be able to surpass Japan within 10 years.

CEOs across India speak on strategy and leadership, in an exclusive series developed jointly by Outlook Business and the Institute for Competitiveness. The Strat Speak Series was published with Outlook Business on December 11, 2010.